Everyone is aware of the impressive scalability and throughput of the Polygon blockchain. But do you think the DEX platform created on the Polygon blockchain performs better in productivity and performance? Yes, Polygon makes this magic for many decentralized exchanges with agile infrastructure and layer2 scaling solutions. According to Alchemy, Polygon now hosts over 40+ decentralized exchanges, nearly half of Ethereum’s count (83). So imagine how Polygon decentralized exchanges could dominate the DeFi space in the future.

A decentralized exchange on Polygon benefits from lower gas fees, high-speed transactions, and unlimited scalability. All these factors highlight how building a DEX on Polygon is a smart decision. But to make your DEX stand ahead of the crowd, you should understand the business values of Top DEXs on Polygon. Regarding that, this blog will be your best companion in making informed decisions.

In this blog, we will explore the 7 best decentralized exchanges on Polygon and suggest you the solution to launch your DEX business. Let us sign in to the blog with….

Why Should You Create a Decentralized Exchange on Polygon?

Creating a DEX on Polygon offers more technical and financial benefits for startups and entrepreneurs. Here are the key benefits you can consider.

Scalability and Speed

Decentralized exchanges have automated processes powered by smart contracts. Polygon network can handle up to 65000 transactions per second thus offering quicker transaction verifications. Further, polygon’s multi-chain infrastructure can enable layer2 scaling solutions to your DEX for higher scalability.

Transaction Fee Advantages

Polygon has a lower gas fee structure compared to other blockchain networks. According to Polygonscan, the maximum gas fee recorded in Polygon transactions is $0.27. However, the Grafa report highlights the transaction fees of Bitcoin as $1.34 and Ethereum as $1. The lower transaction fee can attract more trading activities and lead to higher profits.

Interoperability

Polygon is an EVM-compatible blockchain with support for Ethereum smart contract functionalities. This enables easy transfer of assets and allows developers to create cross-chain compatible applications. Further, you can easily overcome liquidity issues and connect with potential asset holders of both blockchains.

Higher Return on Investment

DEXs on polygons generally receive higher transactions due to lower transaction costs. The higher scalability lets your DEX execute larger trade volumes effortlessly. As a result, your decentralized exchange will generate a higher return on investment in a short span.

Incentives and Tokenomics

The decentralized exchange platform requires a native token functionality for various processes. With dynamic tokenomics, Polygon tokens can help you reward users and governance rights. This will help in maintaining user retention and building a strong community for your DEX platform.

These are the key benefits of building the best DEX on Polygon. Exploring the business model and unique features of the top decentralized exchanges of Polygon can widen your understanding. So here we explore the…

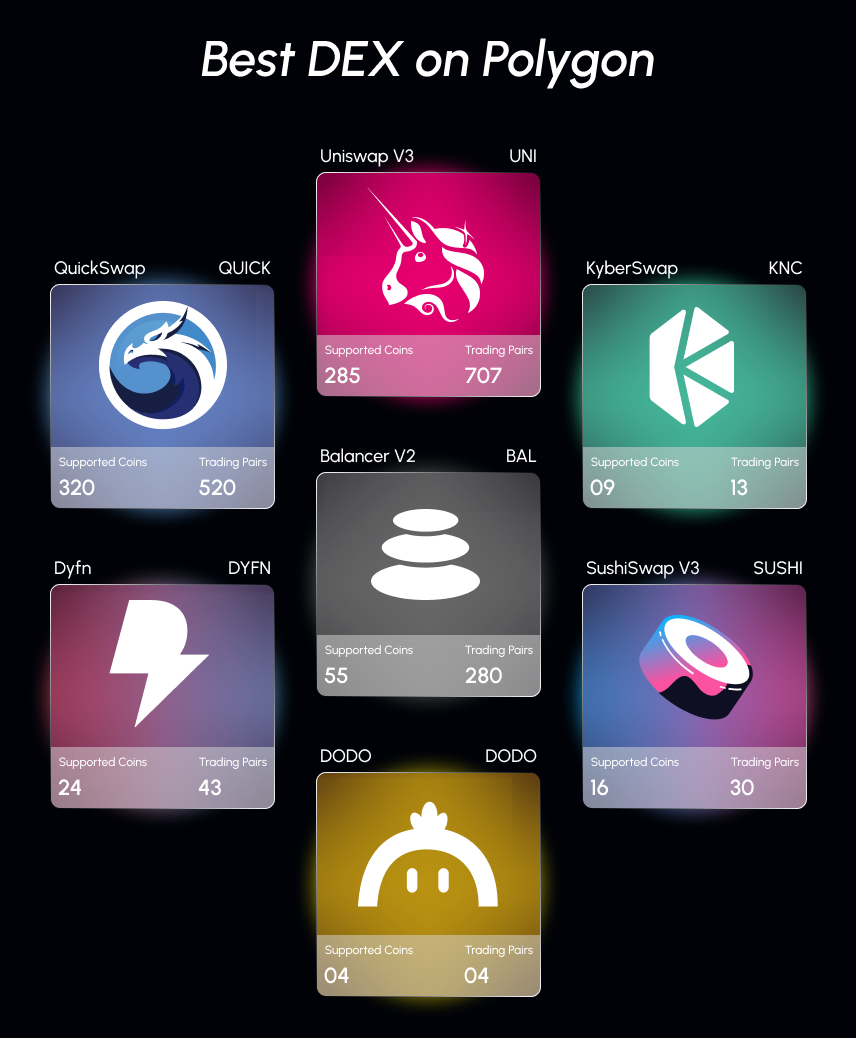

7 Best DEX On Polygon For 2025

Here are the 7 best decentralized exchanges on Polygon considering their unique features, market reputation, and daily trade volume.

- Uniswap V3

- QuickSwap

- KyberSwap

- Balancer V2

- Dyfn

- SushiSwap V3

- DODO

Let us now explore how they carry the edges of the Polygon blockchain in business operations perfectly.

1. Uniswap V3

Uniswap is known as the first decentralized exchange with an Automated Market Maker (AMM) feature. The second-generation Uniswap only supports the Ethereum blockchain. It allows the trading of different ERC20 tokens and makes over $135 billion in trade volume. A step ahead, Uniswap V3 supports 11+ blockchains including Ethereum and Polygon. This makes Uniswap the best DEX on Polygon with reduced transaction fees and boosted trading practices.

Unique Features of Uniswap V3

- Concentrated liquidity, multiple fee tiers, and low slippage trading.

- Higher liquidity ensures minimal capital risks.

- Flexible fee options (0.05%, 0.30%, and 1.00%).

- Adjustable liquidity options with ‘Range Orders’.

- Bug bounty program for security upgrades.

- UNI – A native token of Uniswap serving governance and platform operations.

Key Takeaways

- CoinGecko estimates the approximate daily trade volume of Uniswap V3 (Polygon) is around $78.32 million.

- Uninswap ranks as the best DEX on Polygon’s blockchain by supporting 285 coins and 707 trading pairs.

- Uniswap Labs and Fireblocks collaborate to offer more DeFi services to users via advanced Uniswap Trading API.

2. QuickSwap

QuickSwap is a leading Polygon Decentralized Exchange that began its operation in 2020. QuickSwap is best known for its services in trading, swapping, farming, liquidity providing, and staking. All transactions facilitated by this DEX platform incur certain fees. With wallet connect features, traders can connect with 460+ prominent crypto wallets. Along with Polygon, QuickSwap supports 10+ blockchains and allows users to buy assets as they wish.

Unique Features of QuickSwap

- Perpetual trading with upto 100X leverage at zero gas fees.

- Permissionless swapping of any ERC20 tokens.

- Users can earn upto 0.25% of the liquidity fees.

- Has a built-in yield farming platform – Dragon’s Lair

- QUICK – A native token of QuickSwap serving governance and platform operations.

Key Takeaways

- The trade volume of QuickSwap stands at $4.33 million according to CoinGecko’s report.

- Quickswap supports 320 coins and 520 trading pairs as one of the best DEX on Polygon

- QuickSwap extended its blockchain support recently to Soneium to bring new DeFi business opportunities.

3. KyberSwap

KyberSwap is a decentralized exchange with built-in aggregator services based on the Polygon blockchain. This Polygon Decentralized Exchange has a quicker swapping and limit order trading feature. The users can earn from interest for liquidity providing and staking as per industry standards. KNC (Kyber Network Crystal) is the native token of the KyberSwap exchange providing voting and governance rights. With access to diverse assets, KyberSwap provides liquidity to various decentralized exchanges.

Unique Features of KyberSwap

- Compatible with 13+ blockchains including Polygon, Ethereum, and more.

- Built-in DEX aggregator that supports 70+ DEXs for market-making and liquidity options.

- Swapping, earning, and governing features under one platform make QuickSwap the best DEX on Polygon.

- KyberSwap DEX has a deeper liquidity thus providing the best trading experience.

Key Takeaways

- KyberSwap’s daily trade volume is $4,177 as per CoinGecko.

- This DEX on Polygon supports 9 coins and 13 trading pairs.

- KyberSwap’s DEX mobile app is expected to launch in the Q2 of 2025.

4. Balancer V2

The Balancer is an AMM-based Polygon decentralized exchange built with swapping and liquidity-providing features. Now this decentralized protocol is upgrading to version 3 to support enhanced AMM features and more trading pairs. Balancer has upgraded its vault features to enable users to customizable liquidity-providing options. The vault is powered by a smart contract that is responsible for efficient liquidity and boosted earnings for users.

Unique Features of Balancer

- Custom vaults for altering the liquidity as per user convenience.

- Automatic update to pool tokens and their supply secured in vaults.

- Pool Pause Manager for authentication pool operations.

- The native token of Balancer (BAL) is used for reward purposes.

Key Takeaways

- Balancer v2 (Polygon) trade volume is around $846,604 as per CoinGecko’s report.

- This DEX on Polygon supports 55 coins and 280 trading pairs.

- Balancer V3 will have advanced AMM features and user-friendly functionalities.

5. Dyfn

Dyfn is the limit order-based Polygon decentralized exchange with an RFQ (Request for Quote) matching engine. Dyfn is the best DEX on Polygon with advanced AMM to facilitate trading to all traders irrespective of trade volume. Dyfn is powered by a multi-chain compatible trade engine (Signal) that suggests lower slippage trades across different DEXs. With its cross-chain swapping feature, users can swap assets across 45+ chains. The native token – DYFN serves the utility purposes of the Dyfn ecosystem.

Unique Features of Dyfn:

- Support perpetual and decentralized limit order trading.

- Gas efficient and high-frequency trade match engine.

- Lower fee for on-chain limit order trade execution.

- Dedicated vault contracts for managing user’s funds.

- Concentrated Limit Market Maker (CLMM) for automated trades and efficient liquidity management.

Key Takeaways

- The daily trade volume of Dyfn is $21,842 as per CoinGecko’s report

- Dyfn supports 24 coins and 43 trading pairs for seamless decentralized trading.

- Dyfn launched its first native dApp on the Router chain.

6. SushiSwap V3

SushiSwap is one of the best DEX on Polygon that supports 40+ blockchains. Along with the AMM feature, this decentralized exchange offers additional services including swapping, staking, and liquidity pools. Further, with multi-chain compatibility and access to diverse trading pairs, this Polygon decentralized exchange offers unmatched liquidity. Speaking of revenue, this DEX generates income from cross-chain swapping, liquidity pools, and farming services.

Unique Features of Sushiswap V3

- Cross-chain swapping feature for enhanced liquidity.

- Limit order and DCA (Dollar Cost Averaging) trading feature.

- Built-in fiat-to-crypto conversion feature.

- Upgraded liquidity pools (V3) with customizable liquidity features.

- SUSHI – a native token of this DEX serves governance purposes.

Key Takeaways

- CoinGecko reports the daily trade volume of Sushiswap as $498,272.

- Support for 16 coins and 30 trading pairs makes it one of the best DEX on Polygon.

- Sushi Labs acquired Shipyard Software to address mitigating impermanent loss and efficient liquidity.

7. DODO

DODO is a multi-chain compatible decentralized exchange on the Polygon blockchain. The exchange facilitates limit order trading along with built-in swapping services. The users have complete control over the liquidity pool. They can provide or withdraw liquidity easily at any time. Further, this DEX on Polygon has a built-in token generator to help users create new tokens on desired blockchains. Further, they can raise the capital fund using DODO’s launchpad services.

Unique Features of DODO

- Proactive Market Maker (PMM) algorithm to meet the liquidity requirements.

- User-centric trading experience in same-chain and cross-chain swapping.

- Slippage forecast for limit order trades.

- Bug bounty program and periodical smart contract auditing for enhanced security.

- DODO – The native token serves the governance proposes of the DODO venture.

Key Takeaways

- CoinGecko predicts the daily trade volume of DODO as $246,667.

- DODO supports 4 coins and 4 trading pairs on the Polygon blockchain.

- DODO’s 3rd version is predicted to save 90% of gas fees than AMM-based decentralized trading.

These are the top 7 decentralized exchanges on Polygon Blockchain. You can find the differences in each DEX’s business model, features, and upgrades. So choosing the right one based on your business preference is essential to lead the market competition.

How to Choose the Best DEX on Polygon?

Choosing the best decentralized exchange on Polygon is possible with the following factors. They are,

Security Features

Decentralized exchanges execute transactions in an automated manner. So it should be protected with a robust smart contract, secure login, and encrypted data transactions. The DEX should have risk mitigation strategies and periodical security auditing in practice.

DEX Liquidity

Liquidity is essential to manage trades in decentralized exchange effectively. Higher liquidity ensures smoother and more stable trading practices even in high-volume trades. So checking the efficiency of liquidity pools is paramount to obtain stable DEX operation.

UI/UX Design

Make sure the DEX has a smooth UI/UX design and interface suitable for any grade of traders. A clean and easy-to-navigate UI can enhance users’ active engagement resulting in higher profitability.

Token Availability

Trading pairs and trade execution have a direct relation to the number of tokens supported by the DEX. So choose the best DEX on Polygon supporting more number of tokens for seamless trade execution.

Purpose of Native Tokens

Native tokens efficiently connect the DEX operations by the intent they serve. Additionally, they have been used for governance and utility purposes. Based on your business offerings, choose the DEX and its native token’s role.

Technical Capabilities

Decentralized exchanges should be interoperable, compatible with different blockchains, and flexible to adapt technical upgrades. These qualities are essential to take your business to the next level with different services and collaborations.

These are the prime factors you should consider to choose the best DEX on Polygon. Besides these, transaction speed, scalability, and gas fees are also important. But Polgon’s native blockchain characteristics bring them to your DEX by default. Yet, choosing the right Polygon decentralized exchange is a tough task if your business requirements are not matched correctly.

In this case, building your own Decentralized Exchange on Polygon must be the right solution. I caught your thoughts! You are thinking about the budget and time to launch your own DEX right? No worries! The crypto space has many options to go. The best one is choosing the White Label Decentralized Exchange Software.

How Coinsclone Can Assist You in Building a DEX on Polygon?

At Coinsclone, we are the pioneer in creating White label Decentralized Exchange platforms. We create cutting-edge Decentralized Exchanges that align with your business values and guarantee an exceptional user experience through our bespoke White-label decentralized exchange software.

With mastery of blockchain technology, our professional developers will bring the edges of Polygon into your decentralized exchange. Our experts have 8+ years of practical experience in customizing the DEX solution according to client requirements. All these client-centric strategies make us a market leader in delivering highly innovative, robust, and flexible decentralized exchanges. So why are you waiting? Let us initiate a business discussion to launch your best DEX on Polygon.