Global nations are starting to impose strict regulatory guidelines including mandatory KYC (Know Your Customer) procedures. On the other hand, Non KYC Crypto Exchanges are experiencing higher demands for trading account creation. Can you guess why? People nowadays are concerned more about their privacy and data protection. They prefer anonymous and unrestricted crypto trading features to meet their trading needs.

But would a No KYC Crypto Exchange business be the right deal for startups looking for incredible revenue and future scope?

The rising demand and low regulatory barriers may make the above question valid. But to gain complete knowledge, you should understand how the best Non KYC Crypto Exchanges perform well. In this blog, we will explore the top Crypto Exchanges with No KYC procedure and the key attributes that make them stay ahead of the competition.

Before moving straight to the top list, let us have a glance at…

What is a No KYC Crypto Exchange?

A No KYC Crypto Exchange is a cryptocurrency trading platform that allows traders to perform trading without disclosing or verifying their complete identity. The exchange platform allows for anonymous buying and selling of cryptocurrencies with minimal account creation procedures. Their quicker verification process delivers a higher grade of privacy and convenience to users.

No KYC Crypto Exchanges have security modules and trading options similar to the KYC crypto exchanges. However, they are better at data protection as they do not store users’ data. Similarly, Crypto Exchanges without KYC are somehow better than crypto exchanges with KYC procedures. Here we unlock the…

Reasons to Choose the Non KYC Crypto Exchanges?

Choosing a Non KYC Crypto Exchange for trading offers many benefits to traders and investors. The following valid reasons justify the same.

Quicker Registration Process

The signup process in Non KYC Crypto Exchange is simple and more straightforward. There is no time-consuming or strict verification process. The registration process only requires basic email or mobile number verification.

Lower Risks

No KYC crypto exchanges don’t hold users’ complete data. They value users’ privacy and data security and enable them for anonymous transactions. So crypto exchanges with No KYC generally have lower risks compared to KYC exchanges.

Enhanced Security and Privacy

Non KYC exchanges do not store the payment methods, identity, and other personal information. Traders just need a wallet and are allowed to trade anonymously. These practices ensure greater privacy and security for users.

Global Access

Cryptocurrency trading is a globalized business fulfilling the trading needs of billions of traders. So anyone across the globe can trade with no KYC exchanges with lower regulatory barriers.

Convenience

Traders who want to sell assets quickly without lengthy verification choose crypto exchanges with no KYC. The faster account setup minimizes the waiting time and offers convenient trading.

These potential reasons justify why choosing a crypto exchange with No KYC procedure is a smart move. However, choosing a Non KYC crypto trading platform with the right business model is paramount here. So here we explore the…

7 Best Non KYC Crypto Exchanges of 2025

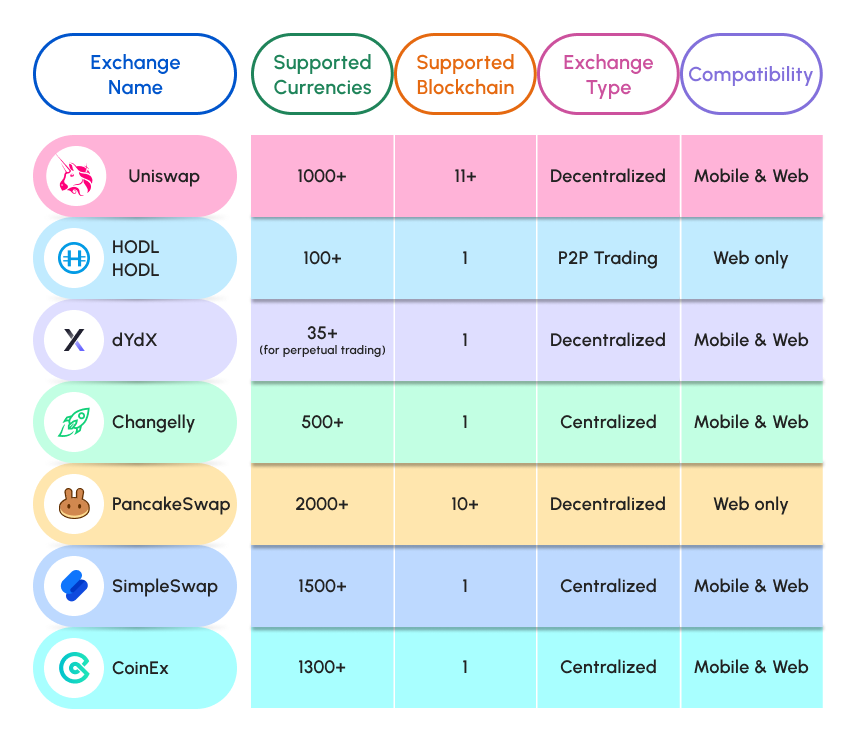

Here are the 7 best Non KYC Crypto Exchanges with top-notch features you can consider in 2025.

- Uniswap

- HODL HODL

- dYdX

- Changelly

- PancakeSwap

- SimpleSwap

- CoinEx

Coinsclone, a leading Decentralized Exchange Development Company prepared the above list considering certain factors. This includes the market performance, currency support, and unique features of top exchanges.

1. UniSwap

Uniswap is a leading decentralized exchange platform without KYC procedures. The DEX platform allows users to trade by simply connecting the wallet to the exchange. Having a TVL of $3.76 billion, UniSwap supports hundreds of tokens. Their incredible trading pairs offer seamless liquidity and trading experience. This Non KYC DeFi Crypto Exchange makes revenue through trading, swapping, liquidity providing, and crypto wallet services.

Key Attributes

- AMM-powered decentralized trading options.

- UNI – native token serves platform and governance purposes.

- Wallet Connect enables multiple dApp connectivity.

- Access to Built-in NFT collectibles.

- Lower slippage compared to other DEXs

2. HODL HODL

HODL HODL is a peer-to-peer non-custodial Bitcoin trading platform supporting 100+ cryptocurrencies. This P2P exchange offers different payment methods allowing users to trade with any currency. Further, this No KYC Crypto Exchange protects users’ funds using multi-signature contracts and escrow services. The user can create trade offers while having complete control over their assets. HODL HODL makes revenue from bitcoin trading and P2P lending services.

Key Attributes

- Anonymous P2P trading feature.

- Lower trading fee structure.

- Multi-signature contracts for secure transactions.

- Escrow for fund management.

- HODL – native token for rewards and liquidity provision.

3. dYdX

dYdX is a decentralized Non KYC Crypto Exchange that has active connections with 180+ cryptocurrency markets. dYdX is built on its own blockchain benefiting traders with low fees and deeper liquidity. Now trader have the complete control and improved DEX trading with this No KYC DeFi Crypto Exchange. The built-in governance model contributed to platform development with user active engagement. The dYdX services are available on web and mobile platforms. And they generate income from cryptocurrency trading services.

Key Attributes

- Advanced order types including price triggers.

- Native token (DYDX) serves governance purposes.

- A private blockchain – dYdX chain powers the dYdX protocol.

- MegaVault is a yield farming pool of dYdX.

- Incentive program for dYdX rewards.

4. Changelly

Changelly is a leading No KYC crypto exchange with support to 500+ crypto assets. Anyone can connect the wallet and start trading within a few minutes. This Non KYC Crypto Exchange facilitates hybrid trading options in partnership with 20+ leading exchanges. Users can trade using fiat or crypto at lower transaction fees. The web and mobile platforms facilitate the trading needs of 2.6 million users per month. Changelly Exchange makes revenue from trading, asset listings, and partnership services.

Key Attributes

- Multiple payment options, including on-ramp and off-ramp payments.

- Smart pricing algorithms enable lower fees.

- Supports 700+ assets for Altcoin exchange.

- Quicker transaction within 5-40 minutes.

5. PancakeSwap

PancakeSwap is a non KYC decentralized exchange on a BNB chain, enabling users to have complete control and privacy. This Decentralized exchange platform supports perpetual and options trading along with swapping, yield farming, and also liquidity-providing features. PancakeSwap uses multi-signature contracts for transactions and conducts periodical auditing to ensure security. As a leading No KYC DEX, PancakeSwap has a TVL of $1.6 billion. Also, its native token and CAKE serves governance and reward purposes.

Key Attributes

- Springboard – A built-in feature to create and launch a token.

- Zero swapping fees for Ethereum and Arbitrum with PancakeSwapX.

- Position Manager for streamlined liquidity provision.

- Syrup pool that offers higher Annual Percentage Rate (APR) for staked assets.

6. SimpleSwap

SimpleSwap is a No KYC Crypto Exchange that supports hundreds of crypto and fiat currencies. The non-custodial nature of this crypto exchange enables users for complete control and asset security. Along with normal trading features, users can benefit from loyalty programs, platinum membership, and more. SimpleSwap makes revenue from its diverse trading features through web and mobile platforms and affiliate services.

Key Attributes

- Crypto to crypto and fiat to crypto trading pairs for seamless trading.

- Rewards and cashback for every cryptocurrency trades.

- Crypto assets are directly dealt with in wallets.

7. CoinEx

CoinEx is a Crypto Exchange with No KYC procedure that supports hundreds of crypto assets and trading pairs. Along with P2P trading, traders can perform swapping, spot trading, and pre-listing token trading. CoinEX makes income from different trading options and financial services like staking, loans, etc. Their trading services are available on web and mobile platforms.

Key Attributes

- CoinEx wallet – Built-in multi-currency supported decentralized wallet.

- CoinEx Smart Chain – A native blockchain for building decentralized applications.

- Earnings through VIP and referral programs.

- Compatible for both beginner and proficient traders.

- CoinEx Token (CET) – A native token for platform services.

These are the best Non KYC Crypto Exchanges you can consider in 2025. The above list is a combination of centralized and decentralized exchange platform with non KYC procedures. Choosing the best type of exchange that meets your requirements must be a tricky process. Isn’t it? Don’t worry! here is the tips to choose the right Non KYC Crypto Exchange Platform.

Tips to Choose the Best No KYC Crypto Exchange

Choosing the right Non KYC crypto exchanges is easy when checking with the following factors.

Security Features:

Crypto wallets should have strengthened security features for protecting data and assets from security breaches. For instance, you can consider

- MFA/2FA for Secure login to crypto exchange.

- Multi-signature wallet for asset security.

- Cold-storage compatibility for asset management.

- Implementing higher-end encryption algorithms.

- Regular security auditing and upgrades.

These are the default security features, you can consider to verify the security of Non KYC Crypto Exchange. The crypto exchange app can be protected further with passwords and biometric authentication.

Trading Options:

Make sure the crypto exchange is designed to enhance active user contribution with advanced trading options. This includes trading features, cryptocurrency support, trading tools, statistics, the number of trading pairs supported, etc.

Operational Limitations:

No KYC Crypto Exchanges have some operational limitations to limit certain platform features. That includes trading options, fee structures, withdrawal limits, and fiat support. Verify that the non-KYC exchange has any such limitations.

Level of Anonymity:

Crypto exchanges with Tier KYC procedure require basic credentials of users to create an account. Based on that, the level of anonymity and privacy protection will change. So always refer to the exchange’s privacy and data policies and guidelines.

Liquidity and Trade Volume:

Non-KYC exchanges with higher liquidity can offer smoother and faster trade execution. Check the exchange has numerous trading pairs to execute high-volume trades quickly.

Customer Support:

Check with customer support and their response time when choosing a Non KYC crypto exchange. The cryptocurrency exchange services should be available 24/7 to help users during emergencies. These are the default factors to consider in choosing the best Non KYC Crypto trading platform. The reasons and tips discussed in this blog are enough to choose the right no KYC crypto exchange for trading purposes.

However, business investment requires innovative services, revenue modules, and add-on configurations to launch a thriving non KYC exchange. So building your own No KYC Crypto trading platform is the ultimate solution to fulfill your business goals.

Turning Wisdom Into Vision – The First Step Towards A Crypto Exchange Business

Non KYC crypto exchanges simplify cryptocurrency trading with minimal legal constraints. Crypto traders and investors prefer these exchanges for privacy-focused, secure, and anonymous trading. Considering the higher demand, you may be ready to start your entrepreneurial role with no KYC crypto exchange business. But think about the hectic scenario. Many popular non KYC defi crypto exchanges like dYdX are charged for not following KYC procedures. Whereas, the future scope of this business becomes a big question mark.

As a potential investor, you may wish to build a future-guaranteed business in a hassle-free manner. If you have a business idea, having a consultation from experts is a smart move. At Coinsclone, we help startups turn their business ideas into visions. If you are eager to launch a crypto exchange business, try your first step with us! Let us progressively build your dream crypto exchange!