Bitcoin. By now, very few people on the planet exist; who haven’t heard about it. So in a little over a decade, it went from being nothing to creating an industry worth over $2.25 trillion. And that’s the power of innovation.

But what is it? And why are people so keen on buying it? What use does it have? What problems does it solve? Don’t worry; we’ll see that in detail in short order.

We’re entering 2023 and looking into a new year of opportunities and wealth. But what awaits us? And that’s what we’ll be discussing here. We’ll see what Bitcoin price will be this new year and how it will affect the crypto market. But it’s more than that; we’re going to take a deep dive into the minutiae of the market.

What is Bitcoin?

Bitcoin is a cryptocurrency. A cryptocurrency is an entirely virtual currency that does not exist in the real world. Bitcoin is the currency you get as a reward for mining the Bitcoin blockchain.

What is a blockchain? A blockchain is a digital ledger that exists in cyberspace. It’s completely open source, and anyone can use it. What does it do? All it does is store data.

The Bitcoin blockchain follows a peer-to-peer, decentralized architecture. What does that mean? In short, there are no central servers to store the blockchain itself. A constantly updated copy of the blockchain gets stored in the computers of every node. These nodes interact with each other in a peer-to-peer network. And there is no geographical topology for the nodes. So, the nodes can be from anywhere in the world. And this is what makes the Bitcoin blockchain decentralized.

The blockchain ledger stores data. What kind of data? Transaction data. If someone buys or sells crypto, that buy/sell data is stored in a blockchain. And to store the data in the blockchain, users need to pay a fee. And that fee is collected and delivered as Bitcoins to the miners who help run the network.

The miners’ only job is to validate the transaction data, store it in a block and add it to the blockchain. And this process is called mining. And for their work, they are paid with Bitcoins.

What are the Factors that Affect Bitcoin Price?

Let’s speculate where the yearly average will land in 2023. But before we get into that, we need to understand the factors that affect Bitcoin prices. Three main factors determine the price of Bitcoin.

- Macroeconomic Conditions

- Bitcoin Futures Market

- Supply

Beyond these three, two more subfactors play a role and have significance when it happens.

- Crypto Regulations

- Miscellaneous

I’ll explain it all in detail and show you how it affects day to day prices of Bitcoin. Let’s look at what they are, shall we?

Macroeconomic Conditions

Believe it or not, the crypto space is the purest example of free-market capitalism. All data is open and transparent, making it more trustworthy than most financial institutions. Governments have little to no control over anything. Bad players in the market, like FTX, go bankrupt, and the governments cannot bail them out using taxpayer money.

The USA is the largest crypto market in the world. After China announced its crypto ban in 2021, the USA has more than taken over the crypto space. Not directly, of course, but more indirectly. So, whatever happens in the US affects the price to develop cryptocurrencies. How? Allow me to explain.

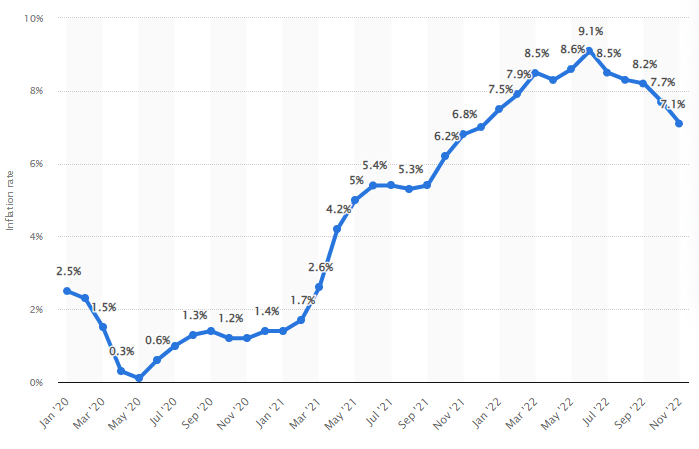

The above chart is the 2022 US inflation chart. In the US, the inflation of the US dollar is now at 7.1%. For reference, the US federal reserve aims to maintain an annual 2% inflation rate. Thus, at the moment, inflation is 5.1% higher than expected. So what does it mean for Bitcoin? I’ll get to that in a moment.

First of all, what’s inflation? Inflation is the decline of purchasing power over time due to a rise in prices. When prices go up, it becomes difficult for people to buy things. So, for example, a bottle of milk will cost, on average, 5% more than the year before. Imagine that, but for everything, from batteries to meat, from bread to wine.

Why does this happen? Inflation is a part of the economic system. The federal reserve maintains a 2% annual inflation to keep up with the growing population and demand. Meaning every year, they will print more money to supply the demand. A 2% inflation rate is better than a deflationary market. And there are many reasons for it, but let’s not digress.

As the US recovers from the Covid-19 pandemic, the federal government has resorted to reckless spending bills. With each spending bill, the fed reserve prints more money. So, simple supply and demand economics dictate that the value of money depends on the demand. And if you print too much money, the value of the said money drops. Since 2020, the US federal reserve has recklessly created more than $4.5 trillion. Seemingly out of thin air. And this has resulted in a spiraling annual inflation rate due to all this money printing.

And to bring this inflation under control, the US federal reserve has resorted to monetary tightening. It essentially means a tightening of monetary policy. The Federal Open Markets Committee (FOMC) sets interest rates, also known as the federal funds target rate. The interest rate is between an upper and lower limit meant for banks. Since June this year, the FOMC has been raising the interest rate.

Now, how does this help with inflation? Printing money, inflation, and interest rates may seem hard to understand, but it’s not. I’ll explain it shortly.

To put it simply, customers deposit money in banks. The deposited funds provide banks; with the capital, they need to extend loans and other forms of credit to their customers. And this lending is what makes money for banks. For banks and other depository institutions to remain stable and solvent, regulators require them to hold a certain percentage of their total capital in reserve. And this percentage shifts constantly, sometimes overnight.

The FOMC’s interest rates directly control the interest rate the banks charge each other and their customers. So, banks will have to hold more capital in reserve while charging more interest for loans. In other words, people, businesses, and institutions will not be able to borrow money. And this will reduce the amount of money that flows through the economy, which will curb rising inflation. So, the higher the interest rate, the tighter the monetary policy. And the stricter the monetary policy, the lower the inflation rate.

As you can see in the chart above, FOMC’s interest rate is at 4.5%, the highest ever. And this rise in interest rate started in June as inflation went out of control. And it is expected to rise to 5.1% in 2023.

The FOMC will keep raising the rates until inflation comes down consistently. And this is a quote from Jerome Powell, the Fed chair at the Jackson Hole economic symposium. “Historical experience cautions strongly against prematurely loosening policy. I would not see us considering rate cuts until the committee is confident that inflation is moving down to 2%…”

So, the interest rates aren’t coming down any time soon. The market is hoping for a fed pivot, but I don’t see it happening in 2023. And without rate cuts, the economy will continue to slow down. Likewise, the UK is suffering from high inflation and a migrant crisis. And the EU is concerned with the Russia-Ukraine war and fuel shortages. And these are all the biggest secondary markets for crypto.

As you can imagine, investments and spending in crypto are slowing down. And as a result, Bitcoin, the largest crypto in the market, will hemorrhage more in 2023.

Bitcoin Futures Market

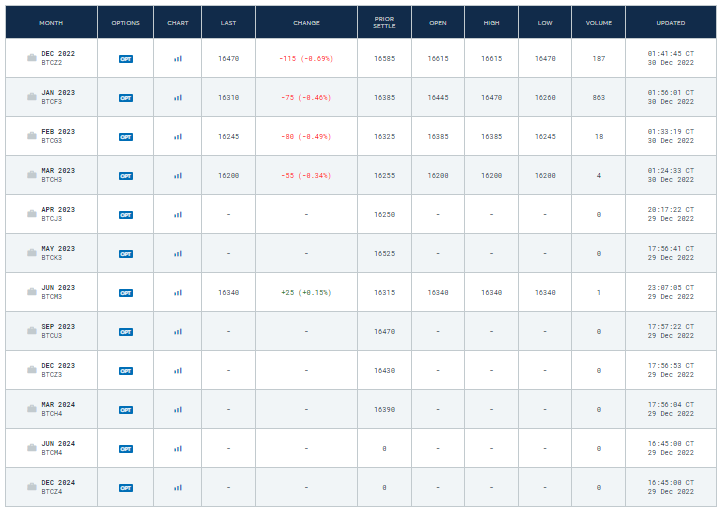

The futures market is a vital part of the equation. Why? Because the stock market is tied to the crypto market in more ways than others. People don’t realize just how much the crypto and stock market correlate. Prolific crypto whales and traders use the stock market brokerages to buy and sell crypto.

Bitcoin dominates the crypto market with over 40% of all trades. And the big investors are resorting to hedging on Bitcoin, using traditional financial platforms. Then the stock market is going to correlate with cryptocurrency development. And if Bitcoin is a commodity, then the futures market on Bitcoin is going to be ten times larger.

For example, each futures contract offered by Chicago Mercantile Exchange (CME) represents a minimum of 5 BTC. So, as you can see, at minimum, each contract is over $80K. Each month, the Bitcoin futures market deals in hundreds of billions in transactions. Thus, any change, loss, or gain reflects in the price of BTC in the broader market.

ETFs, traders, and investors know how to bet on the future of a commodity to ensure maximum profit. And as you can see in the above chart, they do not expect a pivot till June 2023. Bitcoin price prediction 2023 shows bearish signals.

Essentially, how this works goes like this. Traders will bet on the price of Bitcoin on a specific day in the future. They will predict how the price will land, and they will place a bet on it. If the risk is high, the odds of them getting a sizeable return on investment is also high. But if the risk is low, there is a higher likelihood of their bet happening. And so the profit will be smaller. In short, a safe bet means low profit. And the risky bet means higher profit hence a higher chance of defaulting.

So, it’s safe to say that the first two quarters of 2023 will be more painful for Bitcoin and crypto. And when the market pivots and interest rates get cut, Bitcoin demand will rise. As the market rallies, this will boost the Bitcoin price. Hence, we can expect a Bitcoin rally in June and July 2023.

Supply

Despite the ongoing debate about Bitcoin being an inflation hedge, I believe it is an inflation hedge. Believe it or not, Bitcoin is the closest virtual equivalent of gold.

Despite what institutions like JP Morgan and Goldman Sachs are saying, they are quietly stocking up on Bitcoin. And they’re stating contradictory statements because these institutions think that Bitcoin should be available only to the elite. For example, some reports suggest these sentiments from these institutions, which the FTX founder SBF used during senate hearings. And for his many fraudulent schemes, he wanted government regulations for his benefit.

But why is Bitcoin an inflation hedge like gold? Two words are supply and demand. With inflation at its peak, everybody wants to preserve the value of their money. And the only way to do that is by investing in a stable asset.

Gold is a stable asset. Why? Because it’s heavily regulated, and its supply is definite. Every gold that gets mined goes to the government. So, the supply and demand are well-documented. Governments know how much gold is available and where they are. And that’s what makes it so stable.

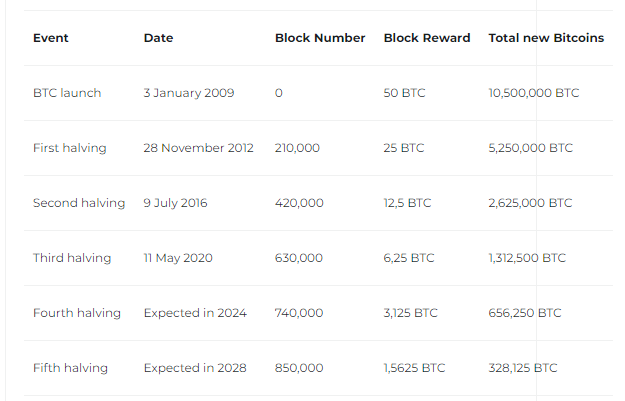

Like gold, Bitcoin has a fixed limit of supply. There can only be 21 million Bitcoins in existence. The blockchain has a limit of Bitcoins it can mint. Roughly 19.2 million of the 21 million Bitcoins are in circulation, 92% of the total supply. And the last Bitcoin will get into circulation in 2140. So, the Bitcoin blockchain will survive for the next 117 years.

As the number of Bitcoins is increasing, technically, it’s an inflationary asset. But every four years or 210K blocks, whichever comes first, there is a halving. A halving is an event where the blockchain adjusts its reward output. When the Bitcoin blockchain went online in 2009, the number of Bitcoins rewarded for each block mined was 50. After the first halving in 2013, that reward halved to 25. In 2016 after the second halving, the blockchain reward halved to 12.5 Bitcoins per block. After 2020, the block reward was halved again to 6.25 Bitcoins per block. The next halving will likely be in June 2024, when the Bitcoin reward will dwindle to 3.125 coins per block.

So, as you can see, the supply of Bitcoins is dwindling while demand keeps growing. And as every country in the world adopts cryptocurrencies are legal tender, demand will soon outweigh the supply. And nations are also conscious of energy-intensive crypto mining, so crypto mining firms are undergoing problems.

And this is what makes Bitcoin an inflation hedge. And so, that gives us hope for Bitcoin price recovery in 2024.

Crypto Regulations

Government regulations are a minor reason to factor into Bitcoin price prediction in 2023. As you may know, till now, crypto remains an unregulated asset. But that is going to change soon. United Nations and all the first-world countries are adopting crypto. And with that adoption comes crypto regulations because only with regulations will crypto become a taxable asset.

Let me list all the crypto regulations from global organizations that have made waves till now.

- IMF – International Monetary Fund [1]

- OECD – Organisation for Economic Co-operation and Development [2] [3]

- FSB – Financial Stability Board [4] [5] [6]

- Bank of Canada [7]

- US Senate Banking Committee [8]

The hope is that with these regulations, institutional money would enter the market. And with massive funding pouring into the crypto space, the Bitcoin price might rally. Most of these regulations will take effect in 2023 and can factor into the Bitcoin Price Prediction in 2023.

Miscellaneous

And now, this is the unpredictable aspect of crypto. And this is essentially the margin of error for any Bitcoin price prediction for 2023. Market conditions vary as events happen in the real world.

For example, each time a major company in the crypto space went bankrupt, the crypto market crashed. And that is not a coincidence. There are implications in the crypto space for every wrongdoing. Crypto firms like BlockFi, Voyager Digital, Three Arrows Capital, Terra LUNA, and recently FTX are a few examples from 2022.

Unfortunately, it is impossible to predict these events looking into the future. And events like these also fuel the fear index among retailers and have long-lasting effects. And thus, this is the possible error in the Bitcoin price prediction of 2023.

Bitcoin Price Prediction 2023 (BTC)

Now that we have looked at all factors that might affect Bitcoin price, let’s look at the prediction, shall we?

Factoring all these above factors, we can estimate a conservative number of $19,500 per Bitcoin for May 2023. And if the market pivots to a more dovish stance on interest rates, and if inflation comes down, we can expect a rally to $25,000 by December 2023. But I wouldn’t expect the Bitcoin 2023 price prediction to go beyond that. Nor would I expect it to reach the $65,000 all-time high till the 2024 Bitcoin halving event.

And if the market doesn’t pivot and interest rates do not go down by June 2023. We can predict the 2023 Bitcoin price prediction to wobble around $20K.

Bitcoin Cash Price Prediction 2023 (BCH)

Bitcoin market dominance is unmatched. Bitcoin is by far the most trusted crypto in the market. And so, crypto like Bitcoin Cash, forked from the Bitcoin blockchain, owes its value to Bitcoin.

Factoring all the facets, we can estimate a conservative number of $100 per BCH by May 2023. And if the market pivots to a more dovish stance on interest rates, and if inflation comes down, we can expect a rally to $150 by December 2023. But I wouldn’t expect the Bitcoin Cash 2023 price prediction to go beyond that. Nor would I expect it to reach the $3000 all-time high anytime before 2025.

If the market does not pivot by the end of 2023, we can expect Bitcoin Cash 2023 price to wobble around $150. Anything is possible.

Bitcoin SV Price Prediction 2023

Like Bitcoin Cash, Bitcoin SV is also a fork of the Bitcoin blockchain. Bitcoin SV price prediction for 2023 is difficult because data is scarcer than BTC and BCH.

Factoring all the facets, we can estimate a conservative number of $100 per Bitcoin SV by May 2023. And if the market pivots to a more dovish stance on interest rates, and if inflation comes down, we can expect a rally to $220 by December 2023. But I don’t expect the Bitcoin SV 2023 price prediction to go beyond that to the all-time high of $500 any time before 2024.

If the market does not pivot by the end of 2023, we can predict the Bitcoin SV 2023 price to wobble around $100 to $120.

Bitcoin Gold Price Prediction 2023

Bitcoin Cash, SV, and Gold are all forks of the Bitcoin blockchain. Like Bitcoin SV, it is difficult to predict the price of Bitcoin Gold for 2023.

We can conservatively estimate the number for Bitcoin Gold from $10 to $15 for May 2023. In addition, if inflation declines and the market shifts to a more dovish position on interest rates, we might anticipate a surge to $30 by December 2023. I wouldn’t estimate the Bitcoin Gold price prediction to go any higher than that. I also didn’t think it would go to the high of $160 anytime before 2025.

Moreover, if by June 2023, the market does not turn around and interest rates do not decrease. Then the Bitcoin Gold price would fluctuate to $15 in 2023.

Concluding Thoughts

Bitcoin price prediction via technical indicators is difficult because the historical data is not comprehensive enough to be reliable. So, all of these are merely conservative estimates. So do take it with a grain of salt. Besides, crypto is too volatile to predict via the macro factors alone. So, all these are ultimately just guesstimates. But I’ve done my best to address all the macro and micro factors. Keep in mind that this is not financial advice.