Did you know that blockchain can speed up financial transactions by up to 90%? Surprising, right? It’s no wonder that over 60% of financial institutions are now exploring blockchain for its enhanced security and transparency. These statistics highlight how blockchain is becoming a prominent technology in transforming the way finance operates.

What exactly gives blockchain such power? Is it blockchain’s core or its goal that makes it so powerful? The answer lies in its decentralized structure that eliminates middlemen, allowing direct, and secure transactions. Whereas in business, blockchain boosts efficiency and trust by tackling fraud, slow processes, and strict regulations. For those unfamiliar with blockchain, it might seem like complex technology. But, once you grasp its role in improving financial operations, it becomes clear why it’s becoming an essential part of modern finance. Let’s dive into how blockchain has flourished in the future of finance.

The Need for Blockchain in the Financial Sector

- All the transactions are kept transparent immutable and reduces the risk of data breaches and fraud. This is due to the blockchain’s nature as a decentralized ledger.

- This automates and streamlines all financial transactions and processes. Due to this factor, it reduces the time and cost associated with traditional methods.

- The need for developing a blockchain application is it provides a clear, tamper-proof record of all transactions, which promotes trust and accountability in financial operations.

- It supports secure and auditable transaction records via regulations, like KYC (Know Your Customer) and AML (Anti-Money Laundering).

Overall, the need to develop blockchain applications in the financial sector is rapidly growing and expanding into various industries. Blockchain’s transparent and immutable structure has proven effective in reducing fraud and data tampering. No matter the industry, indulging blockchain technology is becoming a trend to stay ahead on track.

Benefits of Blockchain in Finance

Having spoken about its growing demand, let’s take a look at the standout benefits that blockchain in finance brings to the table.

Enhanced Security

A major benefit of blockchain technology is its robust security. With the help of advanced cryptographic methods, blockchain ensures that the data and transactions are secured. Each transaction is securely encrypted and added to a chain of records, making it virtually impossible to modify or tamper with. This design creates a formidable barrier against fraud and hacking attempts and offers a much higher level of protection compared to conventional systems.

Increased Transparency

Blockchain operates on a decentralized network, utilizing a shared ledger that grants authorized participants full visibility of all transactions. This heightened level of transparency fosters greater trust between buyers and sellers, as both parties can verify the legitimacy of transactions in real time.

Reduced Transaction Costs

Traditional financial transactions often involve multiple intermediaries, such as banks and payment processors, which contribute to higher costs. Blockchain technology eliminates the need for these intermediaries, resulting in significantly lower transaction fees. This reduction in overhead promotes faster and more cost-effective peer-to-peer transfers, particularly for cross-border payments.

Faster Transaction Times

Blockchain significantly accelerates transaction processing times. In contrast to traditional banking systems, where cross-border payments can take several days to finalize, blockchain enables transactions to be completed within minutes. This rapid settlement enhances liquidity and allows for faster, more efficient financial operations.

Improved Efficiency and Automation

Blockchain platforms utilize smart contracts to automate many processes that would otherwise require manual intervention. These self-executing contracts turn the tasks completed efficiently and reduce the need for human involvement. By automating workflows, blockchain minimizes both time delays and the risk of errors, which simultaneously streamlines the operations and enhances the efficiency of the platform.

High Financial Inclusion

Blockchain in finance facilitates access for unbanked populations globally. With just an internet connection, individuals in remote areas can engage in decentralized financial systems, regardless of their location. This broad accessibility promotes greater financial inclusion and encourages underserved communities to participate in the global economy.

Sounds great right? Now are you also considering, developing a blockchain for your business? If so, read ahead to crack how blockchain can be applied in the finance sector and craft it according to your purpose.

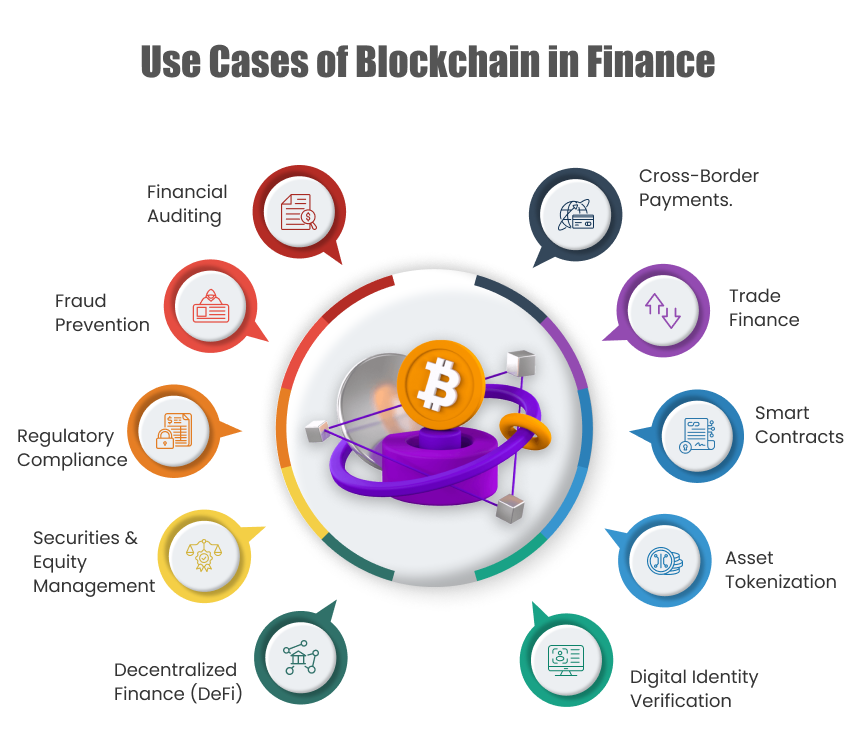

Use Cases of Blockchain in Finance

To gain insights into blockchain’s practical applications. Check out the bountiful use cases of blockchain in finance below.

1. Cross-Border Payments

Blockchain simplifies cross-border payments by enabling near-instant transactions without the involvement of traditional intermediaries, such as banks. Decentralized systems allow international payments to be processed directly between parties, significantly reducing both transaction time and costs. This approach eliminates dependence on foreign exchange markets, enhances liquidity, and makes cross-border trade more efficient and cost-effective.

2. Trade Finance

In trade finance, blockchain simplifies the complex processes involved in international trade, including letters of credit and bills of lading. By automating documentation via a secure, decentralized ledger, blockchain significantly reduces paperwork. This technology enhances transparency between parties, accelerates transaction settlements, and minimizes the risk of fraud, making the trade process more efficient and secure.

3 . Smart Contracts

Smart contracts are self-executing protocols embedded within the blockchain, designed to automatically initiate actions when predefined conditions are fulfilled. This significantly reduces the need for manual intervention. In finance, smart contracts are applied to processes such as loan disbursement, insurance claims management, and handling financial derivatives, thus ensuring accuracy, transparency, and efficiency in each execution.

4. Digital Identity Verification

Blockchain enables secure, decentralized digital identity verification, to protect the users’ data. Financial institutions can authenticate identities without the need for extensive paperwork, thereby you can reduce the onboarding time. This approach also ensures compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations and streamlines regulatory adherence while safeguarding sensitive information.

5. Asset Tokenization

Asset tokenization refers to the process of converting physical or digital assets, such as real estate or equities, into blockchain-based tokens. These tokens represent ownership and can be traded on digital platforms. Tokenization enhances liquidity and enables fractional ownership, allowing investors to buy and trade smaller portions of high-value assets. So blockchain broadens the investment opportunities.

6. Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a rapidly growing sector in the financial industry that provides decentralized financial services without the involvement of traditional institutions. Blockchain technology plays a pivotal role in enabling DeFi, allowing users to access services such as lending, borrowing, and trading directly, without relying on banks. This decentralized approach enhances accessibility to financial services.

7. Regulatory Compliance

A key use case of blockchain in finance is enhancing regulatory compliance via real-time auditing and transaction tracking. Blockchain technology creates an immutable record of all transactions, facilitating easier auditing and regulatory reporting. By ensuring transparency and traceability across financial activities, blockchain significantly strengthens regulatory compliance processes.

8. Securities and Equity Management

Blockchain technology also streamlines the trading of securities by reducing the dependency on intermediaries, such as brokers and exchanges. It enables real-time settlement of equity trades, significantly shortening settlement times from days to mere seconds. This not only speeds up the process but also reduces operational risks, and makes securities & equity management more efficient.

9. Fraud Prevention

Blockchain’s immutable ledger makes it highly resistant to manipulation or alteration of transaction records. By providing a tamper-resistant and auditable record of all financial transactions, blockchain significantly reduces the risk of fraud in payments, trading, and financial reporting. This fosters greater trust and accountability among participants.

10. Financial Auditing

Blockchain enables effortless financial auditing by providing an immutable and transparent ledger of all transactions. Auditors can access holistic and accurate transaction histories without relying on intermediaries, which reduces the risk of errors & speeds up the auditing process. Overall, blockchain offers significant benefits by enhancing the accuracy, efficiency, and transparency of financial audits.

So far, you have explored the potential of blockchain in the finance industry. Now, to bring your ideas to life, you need to know where to build your solution. Coinsclone serves as your starting point, where all your ideas and questions are addressed by a dedicated team that supports, encourages, and guides you. As a leading Blockchain Development Company, our expertise, and the developers at the hub will guarantee you a bug-free implementation of blockchain in finance.

How Much Does it Cost to Build Blockchain-Based Financial Applications?

The cost of developing blockchain-based financial applications is influenced by several factors, such as the complexity of the application, the blockchain platform used, and the development approach. For a basic financial application built on a public blockchain such as Ethereum or Solana, development efforts may include expenses for smart contract creation, which is essential for automating financial processes. However, cost varies significantly depending on the specific requirements and complexity of each project.

For more complex or enterprise-level applications, particularly those utilizing private or permissioned blockchains like Hyperledger or Corda, development costs can be considerably higher. Developing a private blockchain reflects the custom nature of the work, which includes advanced security features and compliance with financial regulations such as KYC and AML. Apart from that, blockchain security audits are essential for financial applications. So this can add to the overall cost, depending on the project’s requirements.

In addition to the initial development of a blockchain application, ongoing maintenance, and updates are crucial. This includes factors like UI/UX design and infrastructure. Maintenance costs can vary depending on the project’s scope. Regular updates are necessary and are mandatory to make sure the application remains functional and secure. The overall cost of developing a high-end financial application depends on its complexity, features, and specific requirements.

On the whole, whether you’re building a simple public blockchain app or a complex enterprise solution, it’s mandatory to consider both Blockchain App development costs and maintenance costs. Read the upcoming to learn about the latest trends and the future of blockchain in finance next!

Future Trends and Advancements

For a lively example, consider Central Bank Digital Currencies (CBDCs). These digital currencies, issued and regulated by central banks, are powered up with blockchain technology to offer greater transparency and security compared to traditional monetary systems.

Developed countries like China have already initiated pilot projects (similar to the Beta version) with their digital yuan ( basic unit of currency in China) to test its functionality. Meanwhile, the U.S. is exploring its own digital dollar. The primary advantage of CBDCs is their ability to eliminate intermediaries, resulting in faster, more secure, and real-time traceable transactions. This shift is set to modernize global financial transactions, all because of the integration of blockchain technology, which enhances control over monetary policies and financial systems.

Looking into the future, we can expect:

- Widespread adoption of CBDCs across more countries, that streamlines both domestic and international payments.

- Faster & more secure cross-border transactions, that reduce the dependency on traditional SWIFT(Society for Worldwide Interbank Financial Telecommunication) systems.

- Greater financial transparency with real-time transaction tracking, so that you can be free of any fraud and money laundering.

- Enhanced monetary control, allows the governments to be more responsive to financial policies.

- Improved financial inclusion which offers more people access to banking services via digital wallets connected to CBDCs.

To Sum It Up

The horizon of blockchain technology in the financial sector is both expansive and transformative. This cutting-edge technology is revolutionizing various industries, with its most profound impact felt in finance. As blockchain applications continue to evolve and innovative solutions emerge in the industry. Most of the businesses across the world have the opportunity to harness its full potential to explore diverse Fintech-related startup ideas. For entrepreneurs, integrating blockchain technology is not merely an option but a strategic move toward cultivating trust and driving operational excellence.

At Coinsclone, we stand ready to be your trusted ally in this digital revolution. Our expertise in integrating blockchain into your business framework promises not only enhanced security and efficiency but also a leap toward a future with impeccable data integrity. Partner with Coinsclone to embrace the future of finance and transform your business into a success story via the power of blockchain.

Blockchain-Powered Financial Solutions for the Future

Secure, Fast, and Transparent Finance Solutions with Blockchain. Fully Customizable to Fit Your Needs.