In the fast-paced world of cryptocurrency, where regulations and governmental vision can make or break a blockchain startup or investor’s dreams, choosing the right country to base operations becomes crucial. As of 2024, several nations have emerged as beacons of crypto-friendliness, each offering unique advantages that cater to blockchain enthusiast’s business needs.

Apart from embracing Crypto, these countries have diversified the payment methods and are encouraging their people to trade and invest in Cryptos. We at Coinsclone have done research and identified the top crypto-friendly countries in 2024. However, some countries have restricted Crypto usage, and it’s time to find out the…

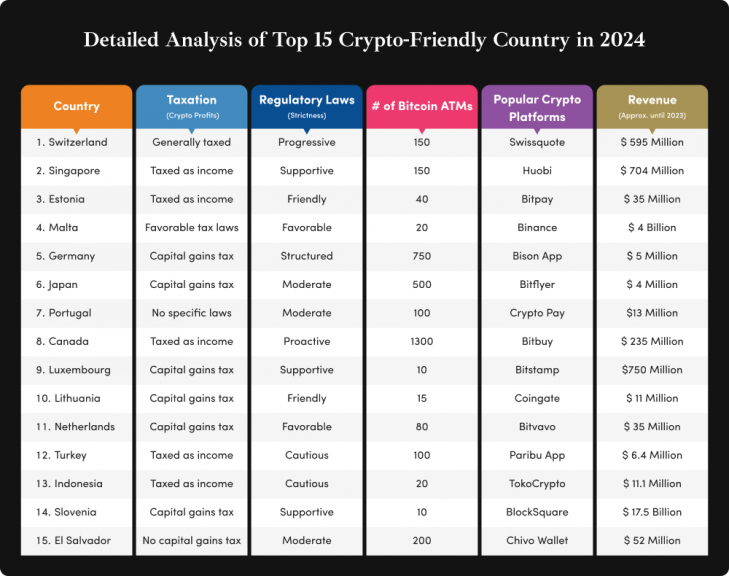

Top 15 Crypto-friendly Countries in 2024

As of 2024, several countries have emerged as particularly crypto-friendly, offering unique regulatory frameworks, supportive infrastructure, and vibrant communities for cryptocurrency and blockchain technology. And also become a popular destination for crypto investors.

Here’s an overview of the top 15 crypto friendly nations

1. Switzerland

Switzerland is renowned for its crypto-friendly regulations and supportive environment for blockchain startups. The country has a clear regulatory framework that attracts many crypto businesses and has become a hub for ICOs (Initial Coin Offerings) and crypto-related investments.

Regulatory Clarity – Switzerland has clear regulations for crypto businesses. The Swiss Financial Market Supervisory Authority (FINMA) categorizes cryptocurrencies, providing a structured framework for operations.

Crypto Valley – The region around Zurich and Zug, known as Crypto Valley, hosts numerous blockchain startups and has a supportive ecosystem of investors, advisors, and legal experts.

Tax Treatment – Switzerland offers favorable tax conditions for cryptocurrency holders and businesses, contributing to its attractiveness as a crypto hub.

2. Singapore

Singapore has become a major hub for fintech and crypto in Asia. The country has clear regulations that support innovation in blockchain and cryptocurrencies. It has also actively attracted blockchain companies through various initiatives and regulatory clarity.

Clear Regulations – Singapore has clear guidelines from the Monetary Authority of Singapore (MAS) that encourage innovation while ensuring financial stability and consumer protection.

Fintech Hub – Singapore is a major fintech hub with strong support for cryptocurrencies from banks, investors, and government initiatives like the Singapore Blockchain Innovation Program.

Global Connectivity – Singapore’s strategic location and strong digital infrastructure make it a gateway for crypto businesses looking to access markets in Asia and beyond.

3. Estonia

Estonia is known for its e-Residency program and its modern way of governing digitally. It has rules that are good for blockchain and cryptocurrency startups, making it a popular place for people who want to start crypto-related businesses.

Digital Governance – Estonia is known for its advanced digital infrastructure and e-Residency program, which allows entrepreneurs to start and manage businesses online, including ones related to crypto.

Blockchain Regulation – Estonia has made rules that are good for blockchain and supports initial coin offerings (ICOs) and blockchain development. This helps innovation while also making sure that everything is legal and protects investors.

Government Support – The Estonian government actively supports blockchain initiatives by working with private companies and through things like the Blockchain Center of Excellence.

4. Malta

Malta has positioned itself as the “Blockchain Island” due to its proactive stance on blockchain regulation. The country offers a comprehensive legal framework tailored to cryptocurrencies and blockchain technology, aiming to attract businesses through clear guidelines and incentives.

Blockchain Island – Malta has positioned itself as a leading jurisdiction for blockchain and cryptocurrencies with its comprehensive legal framework known as the Digital Innovation Authority Act (DIAA).

Regulatory Certainty – The DIAA provides a clean regulatory environment for ICOs, exchanges, and other crypto-related businesses, attracting companies seeking legal certainty and consumer trust.

Tax Benefits – Malta offers attractive tax incentives for blockchain businesses and has created a welcoming environment for crypto entrepreneurs and investors.

5. Germany

Germany has been proactive in adopting blockchain technology and regulating cryptocurrencies. Being the most supportive country for crypto, it recognizes Bitcoin as a legal financial instrument and has created a conducive environment for blockchain startups and crypto exchanges.

Crypto-Friendly Regulations – Germany recognizes cryptocurrencies as legal tender and has established regulatory clarity through the Financial Services Supervisory Authority (BaFin).

Innovation Hub – Berlin and other cities host vibrant blockchain communities and startups, supported by government initiatives and academic research institutions.

Consumer Protection – Germany’s regulatory framework emphasizes investor protection and anti-money laundering measures while fostering innovation in blockchain technology.

6. Japan

Japan was one of the early adopters of Bitcoin and has a well-established regulatory framework for cryptocurrencies. The country has a large market for crypto trading and is home to several cryptocurrency exchanges.

Early Adoption – Japan was one of the first countries to recognize Bitcoin as a legal tender and has developed a robust regulatory framework for cryptocurrencies under the Payment Services Act.

Market Size – Japan has a large and active crypto trading market, with exchanges regulated by the Financial Services Agency (FSA) to ensure transparency and consumer protection.

Technological Innovation – Japanese companies and financial institutions are actively exploring blockchain applications, contributing to the country’s reputation as a leader in fintech and cryptocurrencies.

7. Portugal

Portugal has emerged as a crypto-friendly country due to its tax-free status on cryptocurrency trading and lack of VAT on transactions. It has attracted digital nomads and crypto investors looking for a favorable tax environment.

Tax Incentives – Portugal offers a tax-free status on cryptocurrency trading for individuals and exempts VAT on crypto transactions, making it attractive for digital nomads and investors.

Digital Nomad Visa – The country’s digital nomad visa program appeals to remote workers and entrepreneurs involved in blockchain and fintech industries.

Entrepreneurial Environment – Portugal has a growing community of tech startups and incubators, including those focused on blockchain technology.

8. Canada

Canada has a progressive approach to blockchain and cryptocurrencies, with clear regulations that foster innovation while ensuring consumer protection. It has become a hotspot for blockchain startups and crypto exchanges.

Progressive Regulation – Canada has implemented clear regulations for cryptocurrencies and blockchain technology, balancing innovation with consumer protection under the oversight of the Canadian Securities Administrators (CSA).

Blockchain Innovation – Cities like Toronto and Vancouver are hubs for blockchain startups and research institutions, supported by government initiatives and academic partnerships.

Investment Climate – Canada attracts blockchain investments due to its stable economy, skilled workforce, and supportive regulatory environment.

9. Luxembourg

Luxembourg is known for its supportive regulatory environment and strong financial sector. It has shown interest in blockchain technology and is attracting crypto startups through its stable regulatory framework.

Financial Center – Luxembourg is a leading financial hub in Europe, offering a stable regulatory environment and access to global markets for blockchain businesses.

Regulatory Support – The country has developed a legal framework that accommodates blockchain technology and fintech innovations, promoting growth while ensuring compliance with international standards.

Investment Opportunities – Luxembourg attracts crypto funds and startups due to its favorable tax regime and supportive infrastructure for financial services.

10. Lithuania

Lithuania has established itself as a crypto-friendly jurisdiction with a supportive regulatory environment for blockchain startups and fintech companies. It offers licenses for cryptocurrency exchanges and has shown interest in blockchain applications.

Regulatory Framework – Lithuania is a crypto-friendly country with clear regulations for ICOs and cryptocurrency exchanges, overseen by the Bank of Lithuania.

Fintech Hub – Vilnius has emerged as a fintech hub in the Baltic region, fostering innovation in blockchain technology through regulatory support and government initiatives.

EU Membership – As a member of the European Union, Lithuania benefits from access to a larger market and regulatory harmonization, enhancing its appeal to blockchain businesses.

11. Netherlands

The Netherlands has been proactive in regulating cryptocurrencies and fostering blockchain innovation. It has a supportive environment for startups and has hosted several blockchain conferences and events.

Innovative Ecosystem – The Netherlands has a thriving ecosystem for blockchain startups and research, supported by government initiatives and academic collaborations.

Regulatory Clarity – The Dutch government has taken steps to regulate cryptocurrencies and ICOs, providing legal certainty while fostering innovation in fintech.

Global Connectivity – Amsterdam, in particular, has emerged as a hub for blockchain conferences and events, attracting international talent and investment in the blockchain space.

12. Turkey

Turkey has shown a growing interest in cryptocurrencies. However, the country has no clear regulations regarding their legality, making it less crypto-friendly. Despite this, there has been a rise in the number of crypto service providers and platforms tailored to the local market.

Government Interest – Turkey has shown increasing interest in blockchain technology and cryptocurrencies as part of its broader digital transformation strategy.

Regulation – While initially cautious, Turkey has been working on regulatory frameworks to integrate cryptocurrencies into its financial system, aiming to balance innovation with consumer protection.

Adoption – Cryptocurrencies are gaining popularity among Turkish citizens, partly due to economic instability and currency devaluation concerns, prompting many to turn to digital assets as an alternative store of value.

13. Indonesia

Indonesia has a growing interest in crypto, especially among its tech-savvy population. Crypto trading is legal on licensed platforms, but using crypto for payments is not allowed.

Tech-Savvy Population – Indonesia has a large and digitally connected population, which is increasingly interested in cryptocurrencies and blockchain technology.

Regulatory Clarity – Indonesia has been working on regulatory frameworks to support the growth of the cryptocurrency sector while ensuring consumer protection and preventing illicit activities.

Economic Benefits – Cryptocurrencies can offer financial inclusion opportunities in Indonesia, especially in regions with limited access to traditional banking services.

14. Slovenia

Slovenia is known for being crypto-friendly, with many crypto and blockchain projects. Income from cryptocurrencies is subject to taxation, but profits from selling coins may be tax-exempt. Mining cryptocurrency is tax-free, but miners need to pay a 25% tax on their earnings.

Blockchain Innovation – Slovenia has a vibrant blockchain community and has been supportive of blockchain startups and initiatives.

Regulatory Environment – Slovenia has adopted a pro-crypto stance with clear regulatory guidelines, making it attractive for businesses and investors in the cryptocurrency space.

Government Support – The Slovenian government has actively supported blockchain projects and has a positive attitude towards technological innovation.

15. El Salvador

El Salvador has embraced Bitcoin as a legal tender, creating a tax-friendly environment for crypto investors and firms. The country also offers tax incentives for cryptocurrency operations, allowing profits and assets from digital currency to remain untaxed.

Bitcoin Legal Tender – El Salvador made headlines by becoming the first country to adopt Bitcoin as a legal tender, aiming to boost financial inclusion and economic growth.

Adoption Initiatives – The government has rolled out initiatives to encourage the use of Bitcoin, such as the Chivo wallet and Bitcoin ATMs, to facilitate widespread adoption.

Innovation Hub – El Salvador aims to position itself as a hub for cryptocurrency innovation and has attracted attention from the global crypto community.

These countries have varied approaches to regulating cryptocurrencies and blockchain technology, but they share a common goal of fostering innovation while ensuring consumer protection and financial stability. Crypto enthusiasts and entrepreneurs often consider these regions welcoming cryptocurrency due to their supportive regulatory frameworks, access to talent and capital, and overall business-friendly environment.

Importance of Choosing the Top Crypto-Friendly Countries

It’s essential to choose the right country before starting a crypto business. It significantly impacts the success and growth of your business for several reasons. Here’s why picking a crypto-friendly country matters:

Long-term Sustainability

Crypto-friendly countries offer crucial support for crypto businesses. They understand the risks and have stable regulations for crypto trading, banking services, legal support, and secure technological infrastructure. This support facilitates seamless transactions, builds trust, and contributes among users to long-term sustainability. As a result, entrepreneurs with long-term plans can surely start a crypto business in these nations with liberal crypto laws.

Regulatory Certainty

Cryptocurrency regulations vary widely across different countries. Opting for Countries with favorable crypto regulations provides you with legal certainty and reduces the risk of regulation. It allows businesses to operate without the constant threat of sudden changes in laws which may lead to disruption of operations or investments.

Taxation Policies

Taxation impacts the profits and operational costs of any crypto-related businesses. Many crypto tax-friendly countries offer favorable tax treatments, such as exemptions or reduced rates for crypto transactions, mining activities, or ICOs. Clear and transparent tax policies enable businesses to plan their finances effectively and allocate resources for growth and development.

Access to Funding

Choosing a country that is supportive of cryptocurrency can make it easier to get funding. These countries have strong legal protections and favorable regulations, making them attractive to investors. Startups in crypto-friendly countries may benefit from increased investor confidence and a larger pool of venture capital and private equity firms that focus on blockchain and cryptocurrencies.

Innovation and Talent Pool

Crypto-friendly countries tend to attract highly skilled individuals in the field of blockchain technology and related areas. The regions are home to universities and research institutions specializing in fintech and digital currencies, cultivating a talented workforce driving innovation. Access to skilled professionals can give startups an advantage in the changing world of cryptocurrency.

Market Access and International Reputation

Establishing a presence in a recognized crypto-friendly jurisdiction enhances a startup’s international reputation and credibility. It can facilitate partnerships with global firms, attract international customers, and open doors to new markets. Cryptocurrency-friendly countries often benefit from positive media coverage and investor attention, further bolstering the profile of businesses based there.

Technological Infrastructure

Blockchain innovation requires reliable internet, digital payments, and cybersecurity. Cryptocurrency-supportive countries invest in advanced technology to support digital currencies and applications.

Government Support and Initiatives

Governments that actively promote blockchain technology through grants, startup programs, and partnerships create a supportive environment. This support can attract investment and talent, establishing the cryptocurrency-friendly legal environment as a leader in blockchain technology.

Financial Services and Banking Support

Access to banking services is crucial for crypto businesses. Crypto-friendly countries have banks that provide services to blockchain startups, promoting credibility and stability in the crypto ecosystem.

Educational and Research Institutions

Countries with educational institutions and research centers specializing in blockchain technology cultivate a skilled workforce and culture of innovation.

These factors collectively contribute to the success of startups in the cryptocurrency industry. By selecting the right location that aligns with their business goals, entrepreneurs can set themselves up for long-term growth and success in the global crypto economy.

Detailed Analysis of Crypto-Friendly Country in 2024

From this detailed analysis, you came to know that each country’s approach reflects its unique circumstances and goals in leveraging cryptocurrencies for economic growth and financial inclusion. Operating or investing in a crypto-friendly country can significantly impact the success of cryptocurrency ventures.

By understanding what makes these countries encourage cryptocurrency use and aligning your goals with their strengths, you can strategically position yourself in the global cryptocurrency landscape.

Final Verdict

It is essential to choose the right jurisdiction for a successful and sustainable crypto venture in the ever-changing landscape of global cryptocurrency adoption. While the top 15 crypto-friendly countries of 2024 provide promising environments for startups, entrepreneurs should proceed with caution and thorough planning.

Collaborating with reputable development companies can significantly reduce risks and ensure compliance with local regulations, thereby protecting investments and promoting long-term growth. By prioritizing partnerships with experienced firms known for their expertise in blockchain technology and regulatory frameworks, startups can navigate the complexities of the crypto ecosystem more effectively.

FAQs on Crypto Friendly Countries

- What other factors should investors consider when deciding where to invest?

Investors should consider factors such as regulatory environment, economic stability, market liquidity, and geopolitical risks when deciding where to invest.

- What are the benefits of starting a crypto business in crypto-friendly countries?

Investing in Countries with pro-crypto policies can offer benefits such as clear regulatory frameworks, lower tax burdens, innovative blockchain ecosystems, and potentially greater market acceptance and leading crypto-adopting countries.

- Which country has no tax on crypto?

As of recent updates, Portugal and Belarus were reported to have no specific taxes on cryptocurrency gains for individuals and countries with low crypto taxes. However tax laws can change, and it’s crucial to verify current regulations.

- Who is the most crypto-friendly country?

Switzerland, Malta, and Singapore are often considered among the best countries for cryptocurrency due to their supportive regulatory environments, favorable tax policies, and initiatives to attract blockchain and crypto-related businesses.

- Can foreigners easily open crypto-related businesses in these countries?

It varies by country, but generally, some countries have regulatory frameworks that allow foreigners to open crypto-related businesses easily, while others may have stricter requirements.

- What are the legal requirements for operating crypto businesses in these countries?

Legal requirements for operating crypto businesses typically include obtaining licenses, complying with anti-money laundering regulations, and adhering to tax laws specific to cryptocurrencies. These may vary significantly across jurisdictions.