Do you know a crypto exchange market cap had an astonishing market boom from $16 billion to $535 billion in 2017 with a growth rate of 3,200%? The massive boom leads many investors to turn their heads towards crypto exchange markets. Crypto exchange owners have extended their wings to the sky after this.

Presently, research experts have envisioned that the market capitalization of crypto markets may reach up to $11.72 billion by 2031 with a CAGR of 12.5%. A question may linger in your mind that, how crypto exchanges are managing to make money with cryptocurrencies? With their spectacular marketing skills, they generate revenue through various streams.

One such popular crypto exchange that makes money without any hidden charges is Coinbase. If you want to know, How Coinbase makes money, then you have landed at the right place. In this blog, we have offered a complete analysis of the revenue-generating streams of Coinbase exchange as a business model for startups.

How Does Coinbase Make Money?

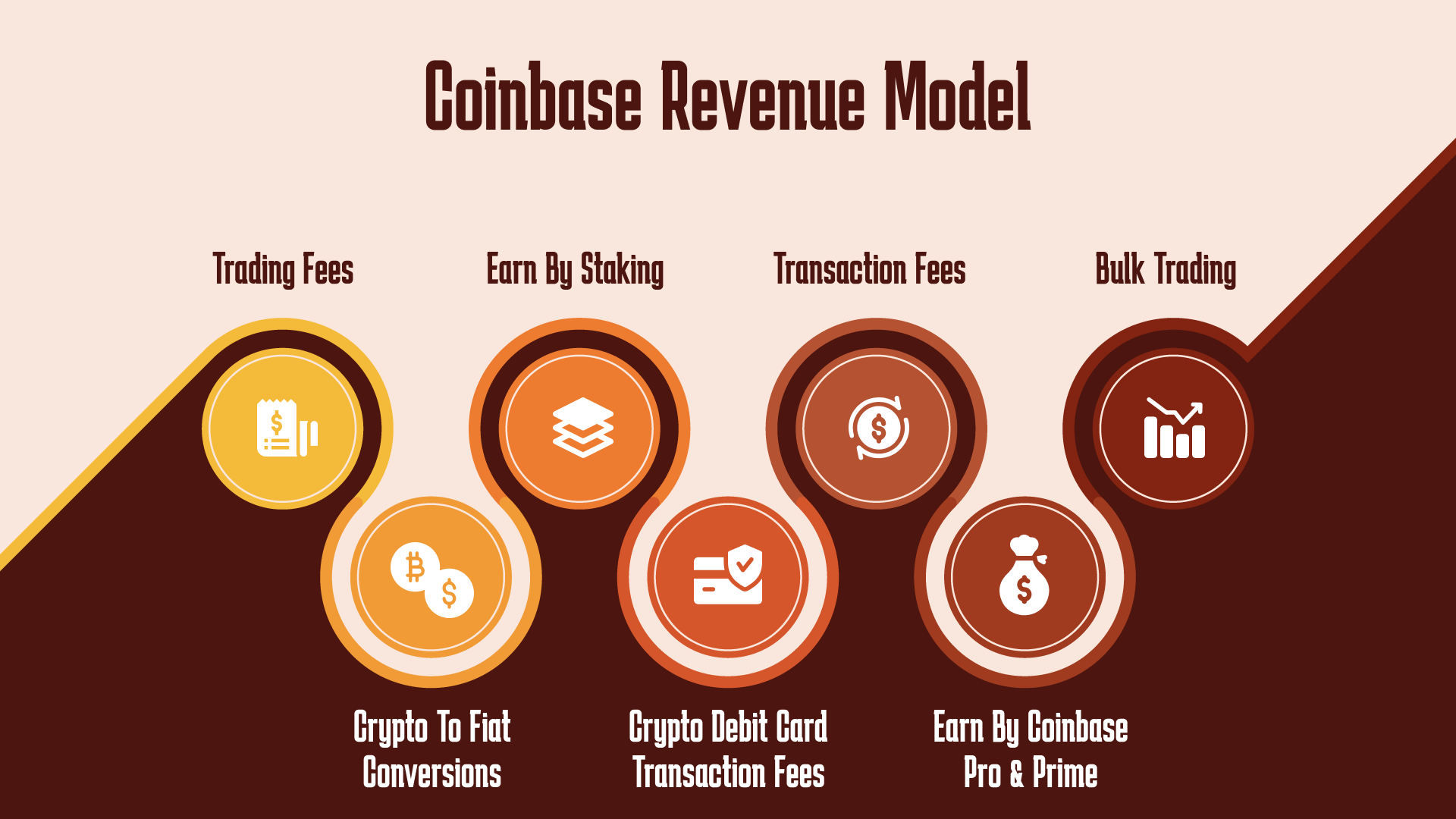

Coinbase possesses numerous ways to reap profits and revenues within the platform. They are enhancing the earning streams day by day which streamlines with the needs and requirements of crypto users.

Trading Fees

Trading Fees are the primary source of every cryptocurrency exchange platform. Coinbase charges a trading fee for the purchase and sale of cryptocurrencies, with a fee of 0.5%. It is applied to all cryptocurrency purchases and sales. Based on the token value, price, blockchain, total transactions, etc, the transaction fee may differ. The trading fees will be the primary contributor to other revenue sources of the Coinbase platform.

Earn by Staking

Crypto Staking is stepping forward in the market as a lot of users are considering holding or locking their assets for a period of time to get excessive interest from the network. so, users hold cryptos in the Coinbase exchange with the option of staking, and their coins help with interest payments in return. For this, Coinbase takes a 2.5% commission on the transaction and distributes the earnings.

Like trading fees, based on the cryptocurrency, its value, blockchain, gas fees, etc, the staking fee may differ. Apart from revenue, staking crypto coins and tokens enhances trust and confidentiality among users.

Deposit & Withdrawal Fee

The transaction of cryptocurrency processing has risen in the past few years since many traders wish to send and receive their crypto by transacting from one platform to another. By utilizing this process, Coinbase charges for transactions, so users pay a total transaction fee of 4% to Coinbase for all cryptocurrency withdrawals.

As Coinbase is a centralized exchange platform, users can withdraw their cryptocurrency and transfer it to their non-custodial wallet. For each withdrawal and deposit, fees are collected.

IEO Launchpad

Startups who want to raise funds for their crypto project can approach the Coinbase admin. In which the admin will promote the newly created crypto tokens and raise funds for the project. For promotional purposes, a certain amount is collected as Launchpad fees from startups.

This also increases the enhancement of the user community and builds trust for buying a new crypto token.

Crypto to Fiat Conversions

Many people want to convert their cryptocurrency to fiat to manage their immediate expenses. So Coinbase helps users to convert all types of crypto to fiat at any time and anywhere. For that, the platform charges the users 2% for all cryptocurrency transactions to fiat. Within the platform, users can convert their fiat into cryptocurrencies without any central party’s approval.

Bulk Trading

Coinbase allows users to fix their desired cryptocurrency, who want to make a purchase or sell. This process helps users to make a huge revenue in a short time. The only thing users should be focused on here is the demand for cryptocurrency in the market.

Startups prefer to build an OTC exchange like Coinbase because it supports bulk trading within the platform. Angel investors and entrepreneurs can trade crypto coins and tokens in a bulk manner without spending much.

Crypto Debit Card Transaction Fees

Coinbase gives a user a debit card that allows them to spend only USDC amounts. The card is free, but Coinbase charges a flat transaction fee of 2.49% on purchases made with that debit card. Like fiat currencies, you can spend the amount from the debit card and execute the crypto transactions completely.

The above-mentioned fee may vary based on the card providers and the card tiers. Fixed fees are eliminated here to adapt with the card policy upgradations.

Affiliate Marketing

Coinbase exchange collaborates with popular companies to promote specific products or services. Revenue can be generated by marketing other companies’ services without any problems. For each click to the external platform, revenue is earned.

Coinbase Pro & Prime

Coinbase Pro & prime charges a fee from users by offering them advanced trading options as well as detailed trade history. The Coinbase team provides a complete guide to its prime users. Exceptional features like learning to earn, staking, low minimum deposit, and high-end security protocols are offered for crypto users.

Users can utilize Prime features like financing, web3, custody, etc. Both Pro and Prime feature plans will differ with the fees.

These are the ways Coinbase allows you to charge an exorbitant fee to the user while still providing the quality service that they require. So, creating an exchange like Coinbase with an above-average revenue-generation process will undoubtedly lead your business to a profit-making business, but it all depends on the service provider you choose to create an exchange like Coinbase.

How Much Does it Cost to Develop a Cryptocurrency App like Coinbase?

The cost to develop a cryptocurrency exchange like Coinbase ranges from $8000 – $14000 when you prefer a Coinbase Clone Script method, which is a pre-built software of the existing Coinbase platform.

Users who like to bulk trade would prefer your platform. So this helps you to gain brand recognition and allows you to attract a large number of users to your platform. So you can proceed with this Coinbase clone script to build a platform like Coinbase without any hesitations. Buying a potential Coinbase Clone script from a reputed crypto exchange script provider is the foremost thing to consider. You can find the best company by considering some of the factors,

- Analyze client testimonials

- Developer team strength

- Technical Expertise

- Clone Script cost

- Technology stack

- Years of Experience

Consider these factors before buying the Coinsbase Clone script from a development company.

Wrapping up

If you want to launch your OTC exchange like Coinbase using the Coinbase clone script, you must focus on its revenue-generating module, particularly on making the users comfortable with the overall process so that you can make a consistent revenue out of it. To implement these specific processes in your business, you will require an excellent service provider.

Here, we the Coinsclone, a team of experts in the blockchain sector provide you with a service by listening to your specific needs and analyzing current market trends to bring you the best possible outcome. As our developer team possesses enough skill in utilizing an advanced-level tech stack, we bring out the potential results in creating a Coinbase clone.