Did you know that over $2 billion worth of transactions took place on Peer-to-Peer (P2P) crypto exchanges in the past year alone? Interesting, right? Have you ever wondered what makes P2P exchanges so popular among crypto traders and investors? If not, this is the perfect time to explore! P2P crypto exchanges have gained the support of crypto investors in recent days because of their decentralized nature.

Among the various types of crypto exchanges, Peer-to-Peer platforms stand out with their robust end-to-end escrow systems. These platforms not only provide exceptional benefits to users but also offer tremendous opportunities for businesses, especially startups and entrepreneurs.

Still unfamiliar with how these powerful P2P platforms work? Don’t worry! We’ve got you covered. Let’s dive in and clear all your doubts about these game-changing crypto exchange solutions.

What is the Difference Between P2P Crypto Exchange and Order-Based Centralized Exchange?

Understanding the difference between Peer-to-Peer (P2P) crypto exchanges and order-book-based centralized exchanges is the most important one for traders and businesses looking to choose the right platform. Here’s a breakdown of their key differences:

Third-Party Involvement

In order-book-based centralized exchanges, the platform’s admin acts as an intermediary to facilitate and regulate trades between users.

Whereas, P2P exchanges eliminate third-party interference, allowing users to transact directly. This platform instead provides an escrow service to proceed with secure crypto transactions.

Fee Structure

Order-book-based Centralized exchanges charge trade fees to ensure that the trade smoothly takes place between two users.

P2P exchanges often have lower trading fees or none at all, making them more cost-effective for users.

Trading Mechanism

Order-book-based exchanges rely on an automated matching engine to execute trades. A limit order, stop order, and Market order are the three main options available in an Order book-based Centralized system for the users to trade and the platform provides detailed information on current trades and pricing.

In P2P exchanges, trades occur directly between users, allowing them to negotiate and adjust prices. There is no automated matching system, but has a greater user involvement.

Next up, we can look at how trade takes place in a peer-to-peer exchange.

What is Peer-to-Peer Crypto Exchange and How does it work?

A peer-to-peer (P2P) cryptocurrency exchange is a platform that facilitates direct trading of cryptocurrencies between users without the involvement of intermediaries. Sellers can create advertisements on the platform, specifying the details of their offers, such as price, payment methods, and quantity. These exchanges are often referred to as “Ad-based exchanges” due to the significant role advertisements play in connecting buyers and sellers.

A P2P crypto exchange uses advanced escrow services to promote secure transactions. For instance, on a platform like Paxful, users must first complete KYC verification. Once verified, sellers can create online sale advertisements, specifying details such as pricing, trade limits, and terms in a free-form message. Buyers who meet these criteria can instantly purchase the listed cryptos instantly.

Paxful’s trading is quite user-friendly, and many startups are looking to develop a low-cost platform like Paxful. Adopting Paxful Clone Script will be a better choice for startups.

Coming back to the point, many are unaware of the benefits of picking a peer-to-peer crypto exchange.

To address this, the following section delves into the key benefits.

What is the advantage of using a Peer-to-Peer P2P Cryptocurrency Exchange?

Peer-to-peer (P2P) crypto exchanges offer numerous long-term advantages for users. Let’s explore the standout benefits of utilizing a secure P2P crypto exchange.

Less Trading Charges

Unlike centralized Exchanges, peer-to-peer bitcoin exchanges charge a minimal percentage. Since the exchanges are completely operated by the people, there are no such high trading charges involved.

Security

Peer-to-peer crypto Exchanges do not hold the funds of their users for a long time. These crypto exchanges facilitate direct connections between traders. With no third-party involvement, the platform enhances safety and provides an added layer of security for users.

Government Intrudence

In Peer-to-Peer Bitcoin exchanges, they are practically invulnerable to government regulations. This is because trading operates without any middle authority.

Therefore, traders are free to trade anywhere, regardless of local or global customers.

Free to Select Cryptocurrencies

Traders don’t just need to stop with Bitcoin in the P2P exchanges. Users can trade with a variety of cryptocurrencies that are supported by the exchange, including Bitcoin, Ethereum, Litecoin, Ripple, Monero, etc.

Abundant Liquidity

P2P crypto exchange users do not have to worry about liquidity as these exchanges have that factor in abundance. The trading volume is usually high in these exchanges, with trust built upon the users through security.

As the P2P crypto exchanges offer this much, they also comprise various enriched features for crypto users.

Features of Peer-to-Peer Crypto Exchange

When users explore a crypto exchange, the platform’s features are often the first aspect they evaluate. Peer-to-peer (P2P) crypto exchanges excel in this regard by offering an impressive set of features designed to meet user expectations. Here are some standout features of a P2P crypto exchange.

- Escrow Service

- Advertisement listing for buying/selling Bitcoin

- Multilingual facilities

- Dispute Management system

- Multiple Payment methods

- Site API

- Attractive User Panel

- Automatic KYC/AML Verification

- Custom Wallet services

- Transparent pricing

- Referral program

Having explored the features, we have compiled a list of some of the most popular and highly regarded exchange platforms gaining attention in 2025.

Best Peer-to-Peer Crypto Exchanges to Know in 2025

There are quite several Peer-to-peer Ads-based exchanges in the industry, but only a few have earned a name for themselves. Here are some of the popular P2P Crypto exchanges for a hassle-free trading experience.

- Binance – One of the popular crypto exchanges is highly named for its P2P crypto trading.

- Paxful – This well-known platform enables users to sell and buy cryptos without any hassles.

- Bybit – International traders who want to trade worldwide can go with the Bybit crypto platform.

- Huobi – This platform is known for its lower costs for both buyers and sellers.

- Kucoin – One of the best destinations for P2P crypto trading at an affordable cost.

Also Read – Top P2P Crypto Exchanges for 2025

These are some of the popular exchanges that have earned immense support from crypto investors. However, you might wonder how these platforms generate revenue. While it may seem like there are only a few ways to earn, that’s not the case. Peer-to-peer crypto exchanges offer a variety of revenue streams that can lead to huge profits.

So, let’s see about…

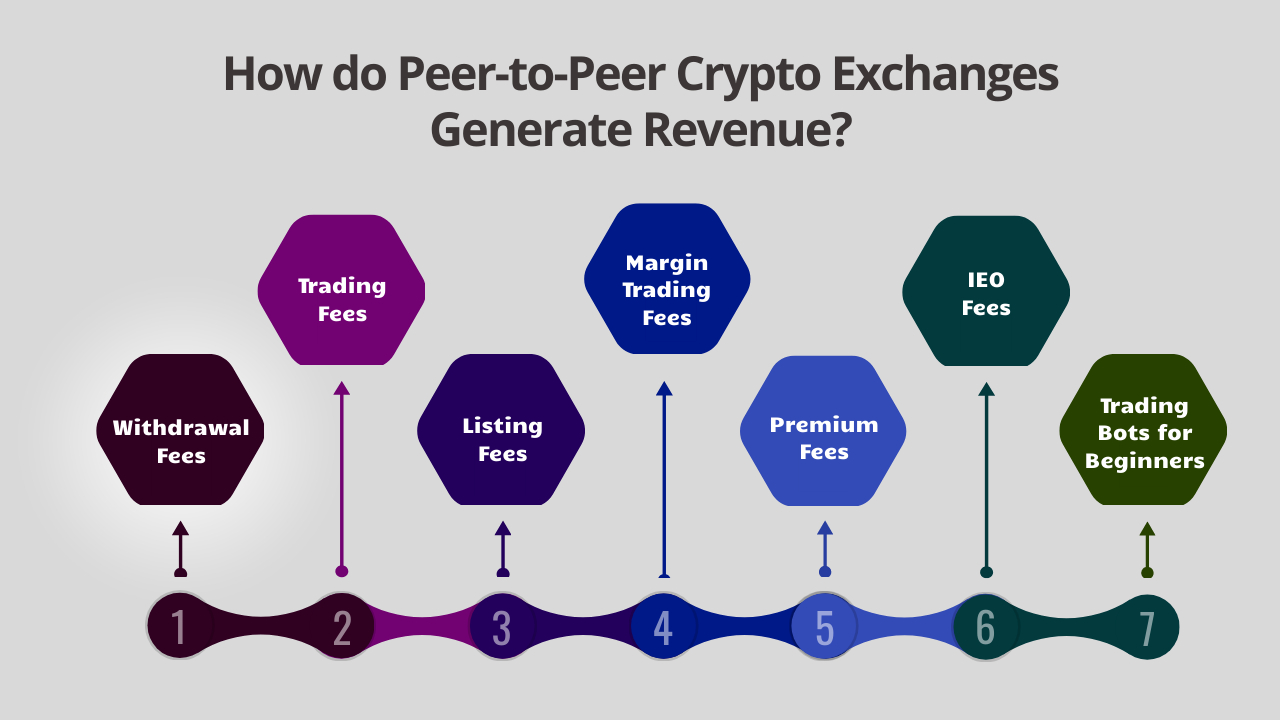

How Peer-to-Peer Crypto Exchanges Generate Revenue?

Peer-to-peer crypto Exchanges have few ways to make money, and not many aspiring startups are aware of it. The more the number of users entering the platform, the higher the liquidity will be, which in turn helps the revenue generation factor. These P2P platforms provide additional security to users, building a strong trust factor among traders.

Once users trust the platform, the owners can establish a percentage of profit in various ways. We have mentioned a few ways to make money in P2P Ads-based exchanges for easy understanding.

Withdrawal Fees

Startups can seek revenue from withdrawal fees for users who try to withdraw their crypto assets. Users must pay a certain amount for every transaction.

Trading Fees

This is the primary source of income for the Peer-to-Peer crypto exchange. Users must pay trading fees for every successful transaction.

Listing Fees

Users who add advertisements for selling crypto assets must pay listing fees. Here, the admin of the Peer-to-Peer exchange ensures only the promising users sell their cryptocurrencies.

Margin Trading Fees

Peer-to-peer crypto exchanges also allow users to buy and sell cryptocurrencies with margin trading features. Users can amplify their trading by borrowing crypto funds which allows the admin to generate revenue.

Premium Fees

Users can subscribe within the exchange platform for specific features, security mechanisms, and plugins.

IEO Fees

Budding startups who want to sell their tokens with the help of the P2P crypto exchange can collect Initial Exchange Offering Fess. The exchange platforms charge fees for marketing, token promotions, due diligence, etc.

Trading Bots for Beginners

Some popular P2P crypto exchanges offer automatic trading bots for crypto beginners to reduce risks. Users can utilize them at an affordable cost.

All these fees come under the direct category. However, futuristic startups should also know the indirect way of generating revenue. Once the exchange has earned its reputation among traders, other features can be included, resulting in profit generation for the owners. This is why Peer-to-peer Crypto Exchange Development has been considered one of the smart business ideas in the market.

Final Insights

On the whole, Peer-to-peer crypto exchange platforms are increasingly becoming a preferred choice for crypto users and investors. They not only provide benefits to users but also present excellent business opportunities for startups entering the industry. If you’re an entrepreneur wondering how to start a P2P crypto exchange this blog would have helped you.

Additionally, if you’re working with a limited budget, then cost-effective P2P crypto exchange scripts will be the best solution. It’s a pre-built software designed to facilitate effortless peer-to-peer trading, thus making it a perfect solution to kickstart your venture efficiently.

Frequently Asked Questions

1. Is Peer-to-Peer Crypto Exchange Safe?

Yes, P2P exchanges are generally safe, since they use escrow services, encryption, and robust security protocols to protect all the transactions.

2. What Types of Cryptocurrencies Can Be Traded on a P2P Platform?

Popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, along with a variety of altcoins can be traded on a P2P platform.

3. How Much Does It Cost to Build a Peer-to-Peer Crypto Exchange?

The cost to build a P2P exchange range from $30,000 to $100,000+. This cost may vary depending on features, technology, and customization.

4. What Steps Are Involved in Developing a Peer-to-Peer Exchange?

The steps involved in developing a Peer-to-peer exchange include planning, designing, developing, integrating security features, testing, and launching the platform.

5. What Are the Security Measures Implemented in Peer-to-Peer Crypto Exchanges?

Escrow services, multi-signature wallets, encryption, and two-factor authentication are some of the most important security features implemented in Peer-to-peer crypto exchange.

6. What Are the Risks Associated with Operating a P2P Crypto Exchange?

Some of the possible risks associated with operating a P2P crypto exchange are potential fraud, user disputes, regulatory compliance challenges, and cybersecurity threats.

7. How Long Does It Take to Launch a Peer-to-Peer Exchange?

The time taken to launch a P2P exchange platform typically takes 3 to 6 months. Depending on the complexity and customization of the platform, the time may differ.